Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

【XM Forex】--Best 7 Data Center Stocks in December 2025

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Forex】--Best 7 Data Center Stocks in December 2025". I hope it will be helpful to you! The original content is as follows:

The emergence of AI has driven demand for data center stocks, ushering in a new technological revolution.

What are Data Center Stocks?

Data center stocks refer to publicly listed www.xmmaker.companies that are actively involved in building and operating data centers. These www.xmmaker.companies are active in construction, power generation, thermal management, and data center operations. There are power-hungry, massive, warehouse-like buildings that house servers and related technology powering AI, the internet, and everything in the cloud.

Why Should You Consider Investing in Data Center Stocks?

Data centers are not a new investment phenomenon, as the internet requires them to operate. The breakthrough in AI adoption in 2022 created a demand boost, as hyperscalers require massive data centers for AI-related operations. The data center market is on track to exceed $600 billion by the end of 2030, as part of the multi-trillion AI sector, with annualized double-digit growth rates.

Here are a few things to consider when evaluating data center stocks:

- Research data center stocks with revenue growth over the past three years.

- Diversify your data center portfolio with www.xmmaker.companies that construct data centers, provide thermal management, and server www.xmmaker.components.

- Mix your data center stock portfolio with www.xmmaker.companies involved in electricity generation.

- Analyze the balance sheet and avoid high-debt data center stocks.

- Check the Power Utilization Effectiveness (PUE), a core indicator of how efficiently the data center operates, together with occupancy rates

What are the Downsides of Data Center Stocks?

The data center segment is highly www.xmmaker.competitive and requires massive capital expenditures to ensure servers run with the most cutting-edge technology. Energy availability is another significant factor, with some hyper-scalers preferring colocation rather than relying on the energy provider. The AI hype has spiked valuations, which is adding to downside risks. The AI boom will eventually slow down, technological breakthroughs could result in lower data center demand than currently planned, and rising electricity costs could threaten capital expenditure plans.

Here is a shortlist of data center stocks worth considering:

- Super Micro www.xmmaker.computer (SMCI)

- Modine Manufacturing (MOD)

- TE Connectivity (TEL)

- Corning (GLW)

- Vertiv Holdings (VRT)

- Flex (FLEX)

- Equinix (EQIX)

Update on My Previous Best Data Center Stocks to Buy Now

In our previous installment, I highlighted the upside potential of Super Micro www.xmmaker.computer and Modine Manufacturing.

Super Micro www.xmmaker.computer (SMCI) - A long position in SMCI between $43.33 and $47.16

SMCI rallied by more than 25% before a massive reversal, but my stop-loss triggered at $55.70, yielding a profit of just above 20%.

Modine Manufacturing (MOD) - A long position in MOD between $129.00 and $141.18

MOD advanced by more than 18%, before plunging and recovering its losses. My stop loss triggered this trade at $162.00, resulting in a profit of over 15%.

TE Connectivity Fundamental Analysis

TE Connectivity (TEL) designs and manufactures electrical and electronic www.xmmaker.components for automotive, aerospace, defense, medical, and energy industries in approximately 140 countries. TEL employs over 89,000 people, including more than 8,000 engineers. It is also a member of the S&P 500.

So, why am I bullish on TEL following its post-earnings slide?

I am bullish on TE Connectivity, as it shows strong demand for its AI applications and a strong position in the Asian transportation sector, which is experiencing rising data connectivity and the expansion of electrified powertrains. With over 70% of its manufacturing localized, TEL has excellent margins and strong free cash flow. It also reported 11% organic net sales growth on an annualized basis and raised its guidance for the next quarter.

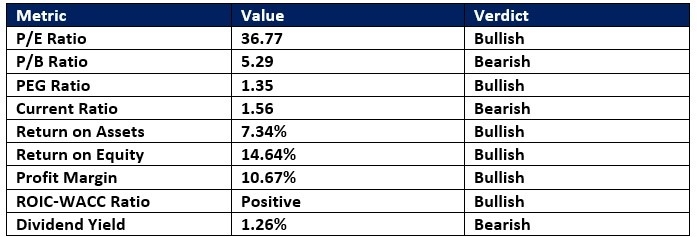

TE Connectivity Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 36.77 makes TEL an expensive stock. By www.xmmaker.comparison, the P/E ratio for the S&P 500 is 30.61.

The average analyst price target for TE Connectivity is $270.47. This suggests good upside potential with manageable downside risks.

TE Connectivity Technical Analysis

TE Connectivity Price Chart

- The TEL D1 chart shows price action breaking out above its ascending 61.8% Fibonacci Retracement Fan level.

- It also shows TE Connectivity breaking out above a horizontal support zone.

- The Bull Bear Power Indicator is bearish with an ascending trendline, nearing a bullish crossover.

My Call on TE Connectivity

I am taking a long position in TEL between $224.18 and $227.64. TEL has a rising presence in AI data centers, and I am bullish on its free cash flow generation.

- TEL Entry Level: Between $224.18 and $227.64

- TEL Take Profit: Between $270.47 and $278.58

- TEL Stop Loss: Between $205.30 and $210.80

- Risk/Reward Ratio: 2.45

Corning Fundamental Analysis

Corning (GLW) specializes in glass, ceramics, and related materials and technologies, including advanced optics, optical fiber, hardware, cables, and data center connectors. It is also a member of the S&P 500.

So, why am I bullish on GLW following its breakout?

Corning offers a well-persified product portfolio, with over 8 billion devices containing www.xmmaker.components manufactured by Corning. Roughly one-third of its revenues are from optical telecommunication equipment, where AI data centers rank among its biggest customers. I am bullish on its forward revenue outlook, driven by the adoption of innovative optical connectivity products for generative AI applications. The rise in video consumption and the deal with Samsung adds to its persified revenue stream.

Corning Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 53.97 makes GLW an expensive stock. By www.xmmaker.comparison, the P/E ratio for the S&P 500 is 30.61.

The average analyst price target for Corning is $93.31. It suggests moderate upside potential with acceptable downside risks.

Corning Technical Analysis

Corning Price Chart

- The GLW D1 chart shows price action breaking out above its ascending 50.0% Fibonacci Retracement Fan level.

- It also shows Corning breaking out above a horizontal support zone.

- The Bull Bear Power Indicator turned bullish with an ascending trendline.

My Call on Corning

I am taking a long position in GLW between $82.82 and $84.59. Its advanced fiber optics for AI data centers should drive future revenue growth, while the 5-year PEG ratio suggests an undervalued share price.

- GLW Entry Level: Between $82.82 and $84.59

- GLW Take Profit: Between $97.98 and $102.87

- GLW Stop Loss: Between $75.77 and $76.15

- Risk/Reward Ratio: 2.15

The above content is all about "【XM Forex】--Best 7 Data Center Stocks in December 2025", which is carefully www.xmmaker.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Decision Analysis】--EUR/USD Monthly Forecast: January 2025

- 【XM Forex】--Natural Gas Forecast: Gaps Higher After Tariffs on Canada

- 【XM Forex】--USD/INR Analysis: Surges Higher and the Need for Perspective

- 【XM Forex】--USD/MYR Forecast: US Dollar Finds Support Against Ringgit

- 【XM Forex】--USD/SGD Analysis: Selloff and Price Velocity Bring Support into Focu