Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Forex】--Best 7 Semiconductor Stocks for Market Movers

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Forex】--Best 7 Semiconductor Stocks for Market Movers". I hope it will be helpful to you! The original content is as follows:

After the PHLX Semiconductor Index (SOX) dropped by 16% year-to-date at the end of April, it soared over 100% by mid-October. Savvy investors made tremendous profits by understanding the underlying currents driving price action.

What are Semiconductor Stocks?

Semiconductor stocks refer to publicly listed www.xmmaker.companies that design and manufacture www.xmmaker.computer chips, also known as semiconductors. They are an essential www.xmmaker.component in today’s world, powering everything from cars to consumer electronics, from telecommunications to energy, and from defense to artificial intelligence.

A semiconductor is a material with electrical conductivity to regulate electrical currents, embedded with tiny circuits. Without semiconductors, we would have www.xmmaker.computer chips with the most basic functions. The sophistication of semiconductors ranges from simple ones that power kitchen appliances to cutting-edge graphics processing units (GPUs) required by artificial intelligence (AI) and defense solutions.

Why Should You Consider Buying Semiconductor Stocks?

Semiconductor stocks drive the global economy, and the integration of AI, www.xmmaker.combined with the recent boost in defense spending, will continue to fuel growth. Some investors www.xmmaker.compare semiconductor www.xmmaker.companies to the internet www.xmmaker.companies during the Dot-Com boom and bust, which have created today’s Magnificent Seven.

Here are a few things worth considering when evaluating Semiconductor stocks:

- Semiconductors are at the forefront of technological innovation, including AI and quantum www.xmmaker.computing.

- Investors must brace for volatility.

- Cyclical cycles will impact the share price of semiconductor stocks.

- The regulatory landscape is bound to change and adapt.

- Most semiconductor stocks have excessive valuations.

What are the Downsides of Semiconductor Stocks?

Many countries consider semiconductors a national security item, as evidenced by Sino-US geopolitical tensions. The industry also relies heavily on Taiwan, with a small but significant factor from the Netherlands. Therefore, supply chain disruptions can distort the investing landscape. High research and development costs and the difficulty and expense of building fabrication plants create significant barriers to new entrants disrupting the sector. Additionally, each significant R&D breakthrough can render previous chips obsolete.

Here is a shortlist of semiconductor stocks worth thinking about investing in:

- Texas Instruments (TXN)

- NXP Semiconductors (NXPI)

- Baidu (BIDU)

- Qnity Electronics (Q)

- Micron Technology (MU)

- Advanced Micro Devices (AMD)

- CEVA (CEVA)

Update on My Previous Best Semiconductor Stocks

In our previous installment, I highlighted the upside potential of Texas Instruments and NXP Semiconductors.

Texas Instruments (TXN) - A long position in TXN between $165.00 and $177.92

TXN dropped by over 11% after my recommendation but has since recovered most of those losses, trading down by over 2%. I maintain my long positions, as bullish catalysts remain.

NXP Semiconductors (NXPI) - A long position in NXPI between $205.14 and $222.22

NXPI plunged over 15%, and I decided to add to my long position at 185.00, as the bullish narrative remains intact.

Baidu Fundamental Analysis

Baidu (BIDU) is a Chinese multi-national technology conglomerate with an expanding AI footprint and a leadership in internet search.

So, why am I bullish on BIDU following its correction?

I rank Baidu as one of my top semiconductor and AI picks, as its Kunlunxin unit and multi-year Kunlun roadmap, including the Kunlun M100 for 2026 and the M300 for 2027, and clustering them into high-performance Tianchi nodes to boost inference and training capacity, are underappreciated. BIDU is considering going open source in its AI business, and it is well persified, with a steady income stream from search that allows it to finance its ambitious AI plans.

The price-to-earning (P/E) ratio of 10.63 makes BIDU an inexpensive stock. By www.xmmaker.comparison, the P/E ratio for the NASDAQ 100 is 34.89.

The average analyst price target for Baidu is $151.41. It suggests excellent upside potential with reasonable downside risks.

Baidu Technical Analysis

Baidu Price Chart

- The BIDU D1 chart shows price action below its ascending Fibonacci Retracement Fan with fading downside momentum.

- It also shows Baidu inside a horizontal support zone with rising breakout pressures.

- The Bull Bear Power Indicator is bearish with an ascending trendline, nearing a bullish crossover.

My Call Baidu

I am taking a long position in BIDU between $108.01 and $118.40. The valuations are a screaming buy, and its ERNIE 4.5, a foundation model, and ERNIE X1, a reasoning model, match US www.xmmaker.competitors at half the price.

- BIDU Entry Level: Between $108.01 and $118.40

- BIDU Take Profit: Between $149.51 and $156.97

- BIDU Stop Loss: Between $88.66 and $93.25

- Risk/Reward Ratio: 2.15

Qnity Electronics Fundamental Analysis

Qnity Electronics (Q) began trading as a separate entity in November, following its separation from DuPont (DD). It provides materials and solutions to the semiconductor and electronics industries via two segments: Semiconductor Technologies and Interconnect Solutions.

So, why am I bullish on Q following its post-IPO plunge?

While Qnity Electronics lacks history as an independent www.xmmaker.company, it has delivered six quarters of solid organic growth, driven by its AI-related products. Its latest AI chip designs and architecture delivered double-digit net sales in its latest quarter. I am bullish on Q as AI demand throughout advanced nodes, advanced packaging, and thermal management solutions should continue to drive a share price recovery following its plunge.

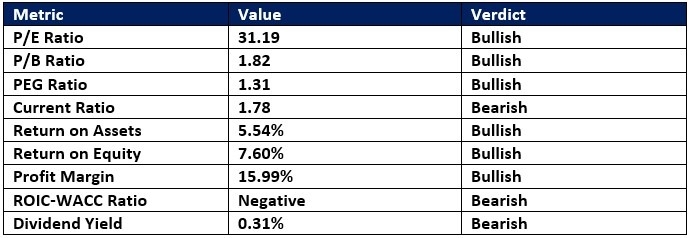

Qnity Electronics Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 31.19 makes Q a reasonably valued stock. By www.xmmaker.comparison, the P/E ratio for the NASDAQ 100 is 34.89.

The average analyst price target for Qnity Electronics is $107.25. It suggests good upside potential with acceptable downside risks.

Qnity Electronics Technical Analysis

Qnity Electronics Price Chart

- The Q D1 chart shows price action breaking out above its ascending 38.2% Fibonacci Retracement Fan level.

- It also shows Qnity Electronics breaking out above a horizontal support zone with rising bullish momentum.

- The Bull Bear Power Indicator is bearish with a positive pergence.

My Call on Qnity Electronics

I am taking a long position in Q between 77.94 and 83.50. I am buying the specialized services for the AI-related semiconductor industry, where Q maintains a unique position.

- Q Entry Level: Between $77.94 and $83.50

- Q Take Profit: Between $102.15 and $107.25

- Q Stop Loss: Between $67.09 and $70.63

- Risk/Reward Ratio: 2.23

The above content is all about "【XM Forex】--Best 7 Semiconductor Stocks for Market Movers", which is carefully www.xmmaker.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Decision Analysis】--USD/MXN Analysis: Test of Near-Term Sentiment About to b

- 【XM Market Analysis】--EUR/USD Forex Signal: Bullish Breakout Beyond $1.0387

- 【XM Market Analysis】--USD/INR Forecast: US Dollar Continues to Flex Against the

- 【XM Forex】--BTC/USD Forex Signal: Bitcoin Sits at Key Support Level

- 【XM Group】--NASDAQ 100 Forecast: Attempts to Break Higher