Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Market Review】--Weekly Forex Forecast – USD/JPY, NZD/JPY, S&P 500 Index, Silver, Gold

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Market Review】--Weekly Forex Forecast – USD/JPY, NZD/JPY, S&P 500 Index, Silver, Gold". I hope it will be helpful to you! The original content is as follows:

Fundamental Analysis & Market Sentiment

I wrote on the 23rd November that the best trades for the week would be:

A summary of last week’s most important data:

There were data points last week that had hawkish implications for the both the Australian and New Zealand Dollars, which tend to be closely correlated. Both these currencies got boosts and will be seen as currencies that will not have their interest rates cut for a while, unlike the US Dollar.

The week saw a modest recovery in risk-on sentiment, with most stock markets gaining a bit. The benchmark US S&P 500 Index is now within sight of its recent all-time high, and is outperforming tech-focused indices

The risk-on sentiment saw the US Dollar fall quite firmly counter to its long-term bullish trend. Key support levels in the US Dollar Index are intact, but the bullish momentum looks questionable. This may be caused partially be increasing expectations over the past week that the Fed will cut its interest rate on 10th December by 0.25%, with markets now pricing an 86% chance of that cut according to the CME FedWatch Tool. The poor Retail Sales data will also have helped push the rate-cutting narrative a little.

Precious metals were the other standout assets of last week, with Silver rising very powerfully on Friday to close at a new all-time high price, and Gold breaking out bullishly from a narrowing triangle chart pattern.

The Japanese Yen continued to remain relatively week despite markets suggesting a 55% probability that the Bank of Japan will hike interest rates soon.

The Week Ahead: 1st – 5th December

The www.xmmaker.coming week will see two or three very important US data points, as well as an inflation print from Switzerland, and Australian GDP data.

This week’s most important data points, in order of likely importance, are:

Volatility this week is likely to be at least as high, and possibly higher, than the volatility last week.

Monthly Forecast December 2025

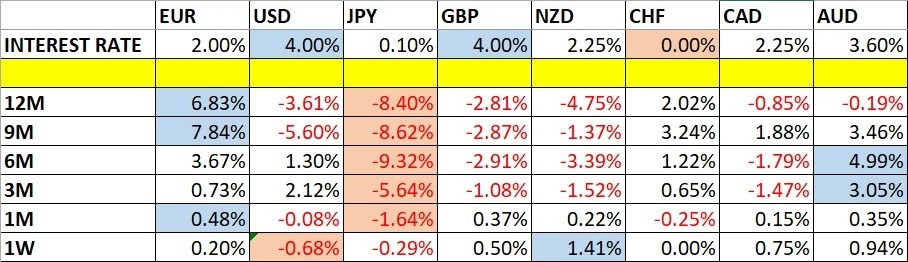

Currency Price Changes and Interest Rates

For the month of November 2025, I forecasted that the USD/JPY currency pair would increase in value.

Its final performance is shown within the table below.

November 2025 Monthly Forecast Final Performance

For the month of December 2025, I make no forecast.

Weekly Forecast 30th November 2025

Last week, I made no weekly forecast.

Last week there was an unusually large price rise in the NZD/JPY currency pair, so I forecast that the NZD/JPY currency cross is likely to fall in value over the www.xmmaker.coming week.

The New Zealand Dollar was the strongest major currency last week, while the US Dollar was the weakest. Directional volatility dropped very slightly last week, with 22% of all major pairs and crosses changing in value by more than 1%.

Next week’s volatility will probably be very similar to last week, although there are a couple of big US data points due which could really move the market if there is any major surprise.

You can trade these forecasts in a real or demo Forex brokerage account.

Technical Analysis

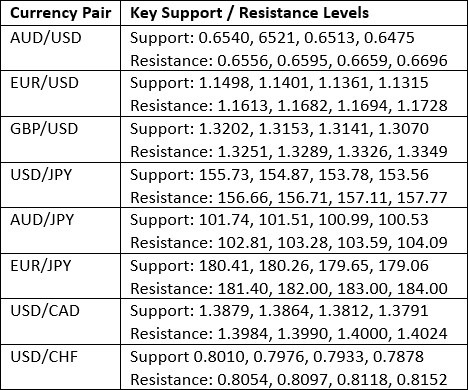

Key Support/Resistance Levels for Popular Pairs

Key Support and Resistance Levels

US Dollar Index

Last week, the US Dollar Index printed a large bearish inside candlestick with only a minor lower wick. The price is still above its levels of both 13 and 26 weeks ago, so by my preferred metric, I can declare a long-term bullish trend is in force, but its continuation looks doubtful. Another bullish confirmation technically www.xmmaker.comes from the fact that the price is holding up above the nearest key support levels, with 98.55 looking crucial. Yet the price action suggests we may not see new highs any time soon.

The Dollar retreated over the week, mostly due to growing risk-on sentiment in stock markets, and chances of a Fed rate cut in December increasing to as high as 86%.

Now that the US government shutdown is over, we will start to get key US economic data releases again, and there are a few items due this week, mostly towards the end of the week, which will probably have an impact on the price.

I think much will depend upon the US metrics which will be released towards the end of this week on inflation, job creation, and consumer sentiment.

US Dollar Index Weekly Price Chart

USD/JPY

The USD/JPY currency pair weekly chart printed a small inside doji candlestick that also resembled a bearish pin bar slightly. This is after the price made a powerful bullish breakout from a very long-term consolidating triangle chart pattern, which is drawn within the price chart below.

Both currencies are in strong trends in line with a long trade here, but both trends are increasingly called into question as the US Dollar weakens ahead of a widely expected rate cut and as expectations move in favour of a rate hike by the Bank of Japan in the foreseeable future.

If you still want to trade in line with the trend, the best way to trade this currency pair is on a breakout rather than a dip. So, anyone looking to enter a new trade here will probably be well-advised to wait for a daily (New York) close above ¥157.77 before entering.

I don’t have much confidence in long trades here, but if we get bullish momentum I will respect it.

USD/JPY Weekly Price Chart

NZD/JPY

The NZD/JPY currency cross weekly chart printed an unusually large bullish candlestick with a small upper wick. The Japanese Yen is one of the weaker major currencies, but the main story here was the huge rebound in the Kiwi after it has been falling for such a long time. This may be a major long-term reversal, because it was driven by the central bank – the Reserve Bank of New Zealand, which cut rates but signaled that the cycle is over, delivering a “hawkish cut” which has sent the Kiwi strongly higher.

Such strong counter-trend movements in crosses like these tend to give up some of the gains over the next week. So although it’s a fairly risky trade, I see this cross as likely to trade lower next week.

NZD/JPY Weekly Price Chart

S&P 500 Index

The daily price chart below shows that this major US stock index made quite a strong rebound after a bearish week previously, which saw a daily close low enough to shake out most trend-following funds. However, many institutions will have kept faith with the idea of 6,500 as the pivotal point and stayed in this long trade, which would have worked out well for them.

Last Friday’s close was just a couple of point shy of the record weekly close, which is a bullish sign.

We remain in a bull market, but I will feel more bullish if we get a new record high daily close above 6,920 – this is what I will want to see before entering a new long trade.

It is a bull market and we are entering December, which typically sees a gain in a bull market, so there are reasons to be bullish, backed by last week’s increase in risk-on sentiment, which will welcome a rate cut by the Fed on 10th December if it happens, as seems very likely.

S&P 500 Index Weekly Price Chart

XAG/USD

A few weeks / months ago, Silver was in a strong bullish trend which saw the price increase by about 50% in only two months. The rise peaked in October and saw quite a strong retracement, which is usually a sign that the price is not going to make new highs soon. This bearish outlook was reinforced by what seemed to be a bearish double top formed just a couple of week ago. However, the price has www.xmmaker.come up again and then made a very strong bullish breakout on Friday with an unusually large move. With Silver on the long side, this usually suggests that we are going to see still higher prices.

Another bullish factor is that all the major precious metals rose in value last week.

As a trend trader I must enter a new long trade, but I am still worried about this trade, so I want to enter with only half of my usual position size.

Silver Daily Price Chart

XAU/USD

A few weeks / months ago, Gold was in a strong bullish trend which saw the price increase by about one third in only two months. The rise peaked in October and saw quite a strong retracement, which is usually a sign that the price is not going to make new highs soon. This bearish outlook was reinforced by what seemed to be a narrowing triangle chart pattern. However, the price has www.xmmaker.come up again and then made a bullish breakout beyond where the upper triangle trend line would lie. With Gold on the long side, this is a bullish sign, but the price is still doing no more than approaching recent highs – it ended last week in an area where it still might print a bearish double top if it reverses within this price area.

Another bullish factor is that all the major precious metals rose in value last week.

As a trend trader I will go long here if the price continues to advance and we get a new daily (New York) close at or above $4,356.

Gold Daily Price Chart

Bottom Line

I see the best trades this week as:

The above content is all about "【XM Market Review】--Weekly Forex Forecast – USD/JPY, NZD/JPY, S&P 500 Index, Silver, Gold", which is carefully www.xmmaker.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Analysis】--ETH/USD Forecast: Waiting for Bitcoin to Make a Move

- 【XM Group】--USD/CAD Forecast: USD Falls Against Loonie

- 【XM Forex】--EUR/USD Analysis: Bulls Await More Stimulus

- 【XM Market Review】--ETH/USD Forecast: Price Drops Rapidly at Open

- 【XM Market Review】--GBP/USD Forex Signal: Gets Oversold Ahead of Key US Data